Deed is a document used to legally transfer title voluntarily from one person to another. The party giving the deed is the grantor and the party receiving the deed is the grantee. When a deed is recorded in the public record, it serves as written evidence of the titleholder’s ownership rights to a property.

Deed is a document used to legally transfer title voluntarily from one person to another. The party giving the deed is the grantor and the party receiving the deed is the grantee. When a deed is recorded in the public record, it serves as written evidence of the titleholder’s ownership rights to a property.

In real estate there are numerous types of deed, each of which serve a very different purpose:

1. General warranty deed offers the grantee the most protection against past and future claims on title. In a general warranty deed, the grantor guarantees there are no limitations or encumbrances on title that are not otherwise expressly listed in the deed. The grantor also attests to the absence of any title defects that arose prior to and during the grantor’s period of ownership.

2. Special warranty deed carries limited protection against title defects. In a special warranty deed, the grantor warrants title against defects occurring during their ownership. This amounts to the grantor’s declaration that the property was not encumbered during their possession, whereas a general warranty deed protects the grantee against any defects created prior to and during the grantor’s ownership. Grantees who receive a special warranty deed typically seek further protection against claims on the title by purchasing title insurance.

3. Quitclaim deed releases a grantor’s interest in a property to a grantee with no warranties. The grantor does not state in the deed that they have any title to the property and quit whatever interest they may have. Quitclaim deeds are frequently used to clear a cloud on title. Quitclaim deeds are not a secure way to acquire property but are helpful in relinquishing ownership interest. When ownership claims arise due to community property rights, inheritance, easements or foreclosure, it is said that a cloud on title occurs and quitclaim deeds are used to clear these types of clouds. Customarily, title companies will not issue title insurance if this method is used to convey title.

4. Trust deed is when property owner owes debt to lender, they convey title to their interest in their property to a neutral third party. The third party holds the title in trust as security for the payment of a loan until the borrower’s debt is satisfied. A deed of trust is similar to a mortgage, in that the property is collateral for payment of the loan, however in a deed of trust the third party holds title until the loan is fully repaid to the lender.

5. Correction deed (or deed of confirmation) is used to repair errors in previously executed deeds. If the property was described incorrectly or if a name was misspelled, a correction deed may be created to correct these errors. A correction deed serves only the purpose of correcting an inaccurate deed. It does not convey ownership interest from a grantor to a grantee.

6. Sheriff’s deed is for when a property is sold at court-ordered public auction as the result of foreclosure. Ownership title transfers to buyer with a sheriff’s deed (or deed in foreclosure) and the proceeds from the auction sale are used to satisfy borrower’s debt to lender. A sheriff’s deed does not have any warranties on title but may include a covenant stating the sheriff’s office did not encumber the title.

7. Tax deed is when a taxpayer defaults on their payment of taxes and the government sells the taxpayer’s property to pay for their delinquent taxes. Ownership transfers via tax deed to the buyer when the property is sold. Like a sheriff’s deed, a tax deed does not make any warranties on title.

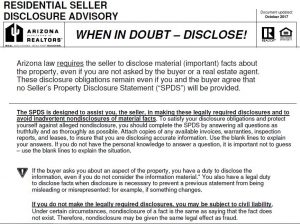

What is SPDS?

What is SPDS? A septic system is used to treat wastewater from a home whenever property is not connected to a sewer line. Septic tanks vary in size (often will hold about 1500 gallons of wastewater), are typically burried 18 to 24 inches below surface, are clearly marked with an identifying pole and should not be driven over or parked on. Septic systems in Arizona also are surrounded by either a leach field or sit on top of a leach pit, to further allow for effluence from the septic tank.

A septic system is used to treat wastewater from a home whenever property is not connected to a sewer line. Septic tanks vary in size (often will hold about 1500 gallons of wastewater), are typically burried 18 to 24 inches below surface, are clearly marked with an identifying pole and should not be driven over or parked on. Septic systems in Arizona also are surrounded by either a leach field or sit on top of a leach pit, to further allow for effluence from the septic tank.

As the close of escrow date approaches, the escrow/title company will ask buyer how they wish to take title (ownership) of the property. It is important to understand the many ways to take title in Arizona:

As the close of escrow date approaches, the escrow/title company will ask buyer how they wish to take title (ownership) of the property. It is important to understand the many ways to take title in Arizona: